Planned Giving: The Complete Guide (+5 Tips to Get Started)

by Dave Martin

by Dave Martin

Similar to major gifts, planned giving is the accumulation of long, engaging relationships between donors and nonprofits. A thoughtful and considerate planned giving program opens your nonprofit up to a significant source of funding and provides donors the chance to continue supporting a cause they believe in.

Establishing a planned giving program requires organizational forethought, strong donor relationships, and a willingness to create long-term investments. Your nonprofit may already be knowledgeable about how to manage its donors, but planned giving necessitates taking additional steps in researching, connecting with, and instilling loyalty in donors.

To help your nonprofit start creating its planned giving program, this guide will provide an overview of core components of planned giving before discussing actionable best practices your nonprofit can use to begin building a successful planned giving program. Let’s start with the basics: What is planned giving?

What is Planned Giving?

Planned giving is formally planning to donate at a later time. Planned gifts can be given at any time but are most commonly willed after the donor passes away.

Planned giving, also known as legacy giving, and is sometimes confused with memorial funds. Memorial funds are nonprofit donations made on behalf of an individual after their passing on by their family, while planned gifts are arranged with the donor during their lifetime.

The Importance of Planned Giving

Nonprofits often devote extensive resources to courting major gifts as the foundation of their fundraising strategy. However, planned gifts on average have a return on investment that is more than $20 higher than the return on investment for major gifts.

Planned gifts are often large as donors can bequeath money without fear of how it will affect their future finances. Additionally, planned gifts usually have lower investment costs as your nonprofit should be working to build relationships with donors as part of your routine stewardship efforts. Rather than hosting large events and other donor cultivation activities in the hope that donors will part with their funding at the current moment, you can leverage your long-term relationships and encourage supporters to pledge their gifts for later.

Confirming a planned gift also provides nonprofits insight into their future financial situation. Unlike other fundraising sources, planned gifts don’t decrease during times of economic hardship. Individuals investing in their legacy aren’t impacted by fluctuating markets or changes in donation regulations.

Planned giving isn’t restricted to just your wealthiest donors, either. Fundraising often begins by creating a model that assesses your donors' ability to give. While models are still relevant to planned giving, your pool of potential donors is often larger than your nonprofit might first assume. More moderate supporters are capable of bequeathing planned gifts to their favorite nonprofits, meaning you don’t just have to ask your largest donors for these contributions.

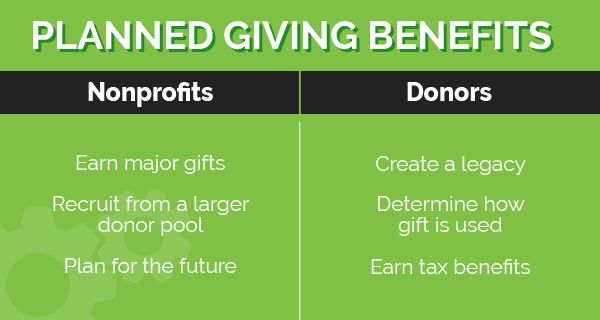

Planned Giving Benefits

Planned giving can seem difficult to talk about, but it’s ultimately beneficial for everyone involved to power through these challenging conversations. Relationship building is key to planned giving programs because planned gifts emerge from mutual respect, loyalty, and transparency between nonprofits and donors.

Planned gifts offer both monetary and emotional incentives for donors and nonprofits, providing a range of incentives for everyone interested in securing a legacy to receiving a tax break.

Benefits for Nonprofits

While your nonprofit obviously benefits from all donations, the specific positives of planned giving are more impactful than many organizations might first assume.

Planned giving requires long-term investment as your nonprofit builds relationships with donors over the course of their lifetime. This may lead to the assumption that planned giving has a low return on investment, when in actuality, planned giving has one of the highest return rates of any donation type.

To understand why this is, here are a few key benefits your nonprofit can gain through its planned giving program:

- Receive substantial gifts. Major gifts are the bedrock of many nonprofit’s fundraising strategies due to a few individuals often providing the bulk of your funding. What counts as a major gift depends on your nonprofit’s average donation size. No matter your nonprofit’s size, planned gifts are usually on par with (if not larger than) major gifts.

- Scout larger pool of donors. Wealthy donors are obviously awesome candidates for both major giving and planned giving. However, because planned giving allows individuals to contribute more in one gift than their budget would normally allow, moderate donors are also able to contribute sizable planned gifts. With a more expansive list of potential donors, every relationship your nonprofit builds becomes even more important to maintain.

- Plan for the future. Once a planned gift is secured, your nonprofit can count on receiving the agreed upon amount of funding, independent of how successful other fundraisers are. The delayed nature of planned giving also requires your nonprofit to consistently think about its future in order to show donors that your nonprofit will still be around when they are ready to bequeath their planned gift.

Benefits for Donors

Planned giving donors weigh different pros and cons when considering a donation than your regular donors do. However, the benefits do exist and are compelling enough that with proper marketing and a well-designed planned giving programs, planned gifts can form the basis of your nonprofit’s incoming revenue.

To help you understand motivations for your potential planned donors, here are a few of the most commonly discussed benefits of planned giving:

- Creating a legacy. As mentioned, planned giving is often referred to as legacy giving, and for good reason! Whether their gift is large or small, planned donors can continue to be remembered and celebrated as your nonprofit honors their contribution. Many nonprofits recognize planned donors who have passed away in speeches, at events, or through program names.

- Determining how their gift is used. While donations to specific campaigns go to particular programs, donors have little control over exactly how their money is spent. Similar to major (and sometimes also mid-tier donations), funds given through wills often come with stipulations and rules that nonprofits need to follow in order to receive the planned gift. This allows donors to decide exactly how they want their gift to be used.

- Earning tax breaks for their family. As with other donations, planned gifts can be deducted from your donor’s taxes, creating a financial incentive for long-term supporters to consider giving to your nonprofit in their will. The exact tax benefits are dependent on your donors’ estate, state, and other factors, which determine the method of giving that is most advantageous.

By building relationships with your donors, you will have the opportunity to iron out details regarding how they want to be remembered, how their money is used, and what tax breaks they qualify for. For example, some donors who want to specific how their gift is used might be curious about what parts of your nonprofit need the most help. By talking it out with them ahead of time, you can provide help that will lead to a win-win situation.

Types of Planned Giving

There are multiple ways for planned gift donors to contribute to your nonprofit. Most nonprofits are given money, but some receive land or other assets. The exact method of donating a planned gift also varies, giving donors a variety of options for what terms they want to give their contribution on.

To understand which planned giving method works best for your nonprofit and your donors, discuss your options openly to come to a choice everyone agrees with. Keep in mind that some forms of planned giving can quickly become complicated, so be sure to track every step of your planned giving process in your nonprofit CRM to stay organized

You should also be sure to thoroughly research each type of planned gift before entering into conversation with a donor about their prospective gift. Build out your planned giving program with the types of gifts that will be most advantageous to your organization and easiest for supporters to contribute. To help your nonprofit get started, here are three common types of planned giving:

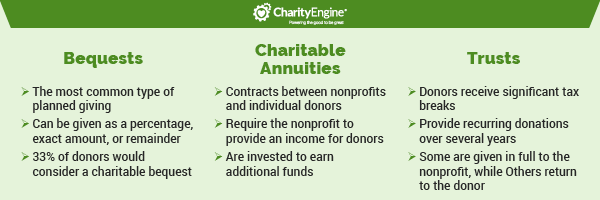

Bequests

With 90% of planned gifts being bequests, this is by far the most popular type of planned giving. This is likely because bequests are the most straightforward planned giving option. Bequests also give donors several options for how they want their money to be given, which generally fall into three groups:

- Exact amount. As the name implies, exact amount bequests are a specific amount of money that the donor agrees to give to your organization.

- Percentage. The nonprofit receives a percentage of the donor’s wealth. This option is often useful for donors with large estates that are only broken up or distributed after their passing.

- Remainder. Your donors likely have wealth they want to give to their loved ones and even other organizations. Remainder bequests grant your nonprofit whatever is left over after all other bequests have been given.

When marketing your planned giving program, let donors know they have multiple options, but consider centering bequests as the preferred giving method. This isn’t just because bequests are easiest for your nonprofit to handle. It’s straightforward, easy to explain, and 33% of Americans have stated they would consider giving a charitable bequest.

Charitable Annuities

Charitable annuities are contracts between nonprofits and individuals where the donor makes a significant contribution (usually monetary but sometimes including other assets such as land or property). In exchange, the nonprofit provides the donor a fixed income for the rest of their life.

Charitable annuity funds are invested by the nonprofit to earn capital gains, and after the pay period ends (or in the event of the donor’s death), the remainder of the gift is then donated to the nonprofit. While smaller nonprofits can create charitable annuity plans, usually only large nonprofit organizations such as universities actively encourage charitable annuities due to the complicated nature of this investment process.

Trusts

There are two major types of charitable trusts: charitable lead trusts and charitable remainder trusts. Both are trusts that provide significant tax benefits to the founder of the trust in exchange for contributing an annual portion of the money to a nonprofit. The difference lies in how the funds donated are calculated and what tax breaks are given to the founder. Here is a more detailed breakdown of their differences:

- Charitable lead trusts are determined for a set period of time, usually ten years at a minimum. The trust gives the selected nonprofits annual payments over the course of the trust. When the trust ends, the rest of the money returns to the donor and their beneficiaries.

- Charitable remainder trusts give annual funds to a specific individual over a period of time. When that period of time is over (or if the founder of the trust passes away), the remainder of the trust is donated to a nonprofit organization.

Trusts are usually established by exceptionally wealthy individuals seeking tax breaks. While your nonprofit may encounter a donor interested in establishing a trust, they are uncommon when compared to bequests.

Marketing Your Planned Giving Program

Planned giving is deeply personal and often emotional, so once you have identified potential candidates, promote the opportunity to them with customized, personal appeals. Keep in mind who your audience is as you craft your message to inspire a deeper connection without inadvertently coming off as rude or scaring them away altogether.

However, while you should adjust your marketing strategy to accommodate planned giving’s specific requirements, you can still leverage tried-and-true marketing techniques such as multi-channel outreach. Your nonprofit should have several avenues of communication at its disposal, and you can use a variety of these channels to inform donors about your planned giving program.

- Your website. Your website is your main hub for information about your donation programs, including your planned giving program. When donors receive marketing materials related to your planned giving program, include a URL to your planned giving page so they can conduct research on their own without the pressure of responding immediately.

- Brochures. It’s difficult to address a wide audience when advertising your planned giving program. However, you can create a tasteful brochure that offers general information about the benefits of planned giving. Unlike fliers, social media posts, emails, or other marketing strategies, brochures communicate a sense of formality that can inspire donors to consider the option on more neutral grounds than if they were asked directly.

- Personal letters. Traditional mail appeals still carry a lot of weight, and a personally written letter lets donors know that your nonprofit is serious about your long-term connection with them. You can make use of templates and other automation tools to speed up the letter writing process, but be sure to take additional time preparing these letters due to their increased personal nature.

When making a direct ask, you can also reach out to donors directly through a phone call or in-person meetings. Make sure donors have privacy and the ability to think about the decision before making a direct ask so as not to pressure them into making a sensitive decision too quickly.

Communicating the benefits to your donors through marketing materials can be effective at getting the word out to a broad section of your audience. However, while some donors may approach your nonprofit to begin the planned giving process, many do need to be asked, making personal appeals a necessity.

5 Tips to Get Started With Your Planned Giving Program

While every fundraising effort your nonprofit launches requires extensive planning beforehand, planned giving is an exceptionally delicate topic that is accompanied by unique legal and ethical considerations. Ensure every member of your team is on the same page about how to approach donors and planned giving candidates, so as to create a sensitive but effective strategy for acquiring planned gifts.

To help give your team a sense of direction regarding how to approach donors, here are five key tips on how to start, build, and maintain relationships with your donors that can lead to planned giving:

1. Focus your energy on retaining existing donors.

Donors develop loyalty to your nonprofit over time. This means that the supporters who are most likely to consider becoming planned gift donors need to have been in contact with your nonprofit for several years (usually at least a decade). In turn, this means you’ll need to retain those donors for years in order to create the opportunity to ask them to consider planned giving options.

Retaining your current donors is ultimately more cost-effective than acquiring new donors, meaning this strategy is key for both your planned giving and other sustainable fundraising strategies. While you can (and should) implement strategies to attract new donors, you should never neglect your existing donor base.

You can show appreciation for your donors by continually providing opportunities for them to participate in your nonprofit through events, meet-ups, and other opportunities that are about more than just donating money. One of the key ways to continually engage donors over time is by showing them that they are part of a community and not just an ATM.

2. Design your planned giving program opportunities.

Many nonprofits create planned giving or legacy societies, creating a sense of community among your planned giving donors. These supporters can join to receive recognition, interact with other donors, and participate in entertaining stewardship activities.

What exactly goes into a planned giving society? Ultimately, these societies create a sense of community and help build the connection between your nonprofit and your planned giving donors. While every nonprofit approaches this in their unique way, a few key strategies to create a well-designed society include:

- Giving it a meaningful name. Branding plays a major role in how donors think about your nonprofit, and a name that evokes emotion or suggests greater importance can make members of your planned giving society feel proud of their inclusion with the group. A strong name can also draw curiosity from potential candidates who may be interested in joining after learning more.

- Collecting donor stories. Anecdotes from your donors about what your nonprofit has done for them or why your cause is meaningful can go a long way in making your donors feel heard. You can then share these stories (with permission) on your website’s planned giving page or bundle them into a collection to share with other members of your planned giving society.

- Creating exclusive events. While few people become a planned giving donor to attend more parties, additional events and opportunities exclusive to your planned giving society can build a stronger sense of community. Not to mention providing a few extra perks like this increases donor loyalty and gives your supporters something to look forward to even after their planned gift agreement is confirmed.

These events and opportunities shouldn’t solely be focused on converting more donors. Give your planned giving donors real, engaging, meaningful activities that will capture their attention and show your appreciation for their involvement with your mission.

3. Create marketing materials for your planned giving program.

Before creating your marketing materials, consider what is important to potential planned giving candidates. While some people are inspired to invest in planned giving due to the tax benefits, the overwhelming majority do it out of genuine personal investment in your cause. In general, technical and statistical information does very little to convince donors when compared to emotional appeals. However, a healthy mix of both is ultimately ideal.

With this in mind, create materials that use stories and images to invoke sentimentality and other feelings that lead naturally towards considering becoming a planned giving donor.

Your brochures and planned giving page will be staples to get the word out about your program details and informing supporters about their options. Therefore, address these materials first, ensuring you have all of the facts on the table for supporters to conduct research before you start reaching out on a personal level.

After you’ve located prospective donors, ensure that your emails, letters, and other appeals are personalized and customized to reflect each candidate’s donor journey. Address them by name, reference how long they’ve been with your nonprofit, and mention previous engagements they have had with your organization’s activities such as event attendance and volunteer experience.4. Locate prospective donors.

Donors need to know your planned giving program exists in order to participate. However, due to the sensitive nature of planned giving, you should avoid posting about it on social media like you would an event or crowdfunding campaign.

Consider your planned giving program’s primary audience. While the pool of potential planned giving donors is larger than that of major gifts, candidates still need to meet their own set of specific requirements:

- A long-term relationship with your nonprofit. Planned giving comes as a last step in a series of relationship-building interactions between donors and your nonprofit. Even if they fit the other two requirements, donors who don’t know your nonprofit well likely won’t be comfortable entrusting you with a planned gift. Avoid asking donors too early in your relationship by tracking previous interactions and only marketing your program after supporters have been with your nonprofit for at least 10-20 years.

- Large to moderate net worth. There are more candidates for planned giving than major giving. However, you can still use wealth prospecting tools to identify potential donors from your current base. Identify those who make regular donations to your nonprofit, how much those donations are, and if they have increased over time. Then compare their giving behavior to the results of your wealth screening to find individuals who are both generous and have enough set aside that they might consider making a planned gift in the future.

- Middle aged to late retirement. Approximately 53% of donors decide whether or not to contribute a planned gift when they first write their will. This means that donors who are ready to make planned gifts are likely to be middle-aged to older individuals, usually between the ages of 40-50. While it is alright to let all of your donors know about your planned giving programs, the only ones who will consider enrolling in it are candidates who have already had the time to accumulate a fair bit of wealth over the course of their lives.

Identifying these candidates takes time as donors get to know your nonprofit and you get to know your donors. Monitor each donor’s engagement history so you can understand where they are on their donor journey to ensure you only ask appropriate candidates to consider planned giving. Once they fit these requirements and your nonprofit has built loyalty with them, you might be ready to make the first approach.

5. Steward and acknowledge your donors.

Thanking and acknowledging your donors’ contributions is an ongoing process. Personal and direct communication lets specific donors feel seen, which encourages them to continue supporting your nonprofit into the future. It might seem repetitive to thank your supporters over and over again, but deliberate and meaningful thank you messages are an integral part of any fundraising campaign cycle for a reason.

There are more ways to recognize your donors than automatic follow-up messages after a successful donation. Sit down and consider all of the ways your donors can participate in your organization, and then thank them when they do so. A few methods you can use to show appreciation outside of email are:

- Phone calls. If a donor made a contribution (especially a mid-tier or larger donation) to your latest campaign, be sure to follow up with them with a phone call within 48 hours. While your call doesn’t have to be long, a brief chat with a member of your team will show donors that your nonprofit is made up of people who see and appreciate every contribution.

- Spotlighting donors. Between your website’s newspage, your social media profiles, and your newsletter, your nonprofit has several ways you can draw attention to donors. Always ask your donors permission before spotlighting them to the public. While some appreciate the attention, others may prefer to donate quietly.

- Personal letters. Sending a handwritten letter or card will let your donors know that your nonprofit took the time to sit down and specifically acknowledge their contribution. Your volunteers can help by writing the cards, which are then signed by your board members or other leadership at your nonprofit.

- Donor walls. For major gifts, sometimes a more permanent way to show appreciation is through public recognition. Donor walls are physical monuments to your donors’ contributions that your nonprofit can place in their office, in a common area, or even in public spaces (with permission) so visitors can come and read their names. Donor walls can be expensive, but remember that they are also an investment in your future fundraising programs.

In your thank you messages, be sure to express how grateful you are for donations, and also relay the gift’s impact. Use statistics and anecdotes from your programs to help donors get a better sense of what exactly your nonprofit is doing and why their donations matter.

Repeated acknowledgment and expressions of gratitude are fundamental building blocks of cultivating positive donor relationships. These opportunities can influence how long donors support your nonprofit and how receptive they will be to future donation requests such as asking for a planned gift.

How CharityEngine Can Power Planned Giving

Donors participate in planned giving programs for nonprofits to which they feel a strong sense of loyalty. Building these relationships doesn’t happen by coincidence. These connections develop over the course of multiple interactions between your donors and your nonprofit.

To track, plan, and solidify these relationship-building opportunities, your nonprofit will need a dedicated software solution to manage the journey of your planned giving donors.

CharityEngine’s comprehensive CRM can equip your nonprofit with key tools to set your planned giving program up for success. Along with being an all-in-one solution for fundraising, marketing, and data organization, CharityEngine allows your nonprofit to:

- Retain donors and build relationships. CharityEngine’s CRM allows nonprofits to gain an in-depth understanding of their donors’ motivations and interactions with comprehensive donor profiles. Additionally, CharityEngine’s status as an all-in-one software keeps your planned giving timelines organized by coordinating all of your relationship-building efforts in one place.

- Locate prospects. Before you receive a planned gift, you’ll need to identify potential planned gift donors. With the help of a planned giving prospecting tool, CharityEngine’s donor database can help your nonprofit analyze every aspect of your supporters’ journeys and record insights from additional prospect research to find donors who may be interested in your planned giving program.

- Track planned gift conversations and opportunities. Planned gifts require careful organization to discover opportunities to build strong relationships and start the conversation about planned giving. You’ll only ever receive a planned gift if you ask your donors, and knowing when it’s appropriate to ask requires careful analysis of your donors’ relationship with your nonprofit. CharityEngine’s focus on donors’ journeys can help create an engagement history timeline. These timelines help your nonprofit understand where your donors currently are on your planned gift timeline and find key opportunities to move them further along towards asking for a donation.

Implementing new technology can be a challenge, and can lead to an initial slow down productivity as staff learn the best practices for their new software. However, in the long-run, an upgrade in your software can lead to a major boost in fundraising options. During your nonprofit’s transition, remember that investing in new technology is an investment in your nonprofit’s future success. Don’t be afraid to reach out to your software provider for additional support getting your team up to speed.

Wrapping Up

Setting up a successful planned giving program is dependent on your ability to craft long-term loyalty and relationships with your donors. Your nonprofit can accomplish this taking the time to listen to donors, engage them further in your organization, and showing how they impact your mission.

This means that before getting started with your planned giving program, you’ll need to conduct extensive research on outreach, donor relations, and giving trends. Here are a few resources your nonprofit can use to begin its journey towards a planned giving program that’s beneficial for both you and your donors:

- Nonprofit CRM | How to Pick the Best Software Solution. Your CRM stores your donors’ information, and the best solution will allow you to organize and use that information to maintain and build relationships. Learn what features to look for to discover the software that meets your specific needs!

- Year-End Giving: Strategies and Statistics for Nonprofits. Do you know when your donors are most likely to give? Understand why the end of the year is such a popular time for giving and what your nonprofit can do to make the most of it.

- Multi-Channel Fundraising: What Your Nonprofit Needs to Know. Converting donors requires reaching out to them—usually multiple times. Get started researching multiple platforms to expand your communication strategy across channels.