Want to know what every single nonprofit has in common? You all need donations to be successful. So whether you’re growing and need some foundational support or you’re enterprise-level and want to be reminded of some techniques that helped you skyrocket, this ultimate guide will cover donations from A to Z. There’s a little something for everyone!

Donations come in all shapes and sizes, and there are just as many ways to ask for them, acknowledge them, and manage them. Whew! Sounds like a lot of work! But fear not, we’ve got you covered.

Nothing can make your nonprofit heart soar more than a major gift that obliterates your fundraising goals, and nothing can lead to more nonprofit sleepless nights than a paltry response to an enthusiastic outreach. You need donations, and people want to support good causes…but there can be an ocean between those two parties.

We’re here to help you sail across it.

CharityEngine has been helping nonprofits raise money for decades. And, if we do say so ourselves, we’re pretty good at it! Our clients, from the biggest (looking at you, Wounded Warrior Project) to the smallest (we see you, Merlin’s Magic Wand!), often ask us for advice on a range of donation topics. In this guide, we have compiled a resource for all nonprofits who have questions about donations or want advice on how to increase donations.

No matter what size nonprofit you are, we’ve got a client just like you…and this is the advice we give them. From startups to enterprise organizations, everyone needs donations to thrive, and we’re here to help you nail it.

In this guide, you’ll learn:

You’ll be armed with all the information and tools you need to invigorate your fundraising efforts! So let’s get started.

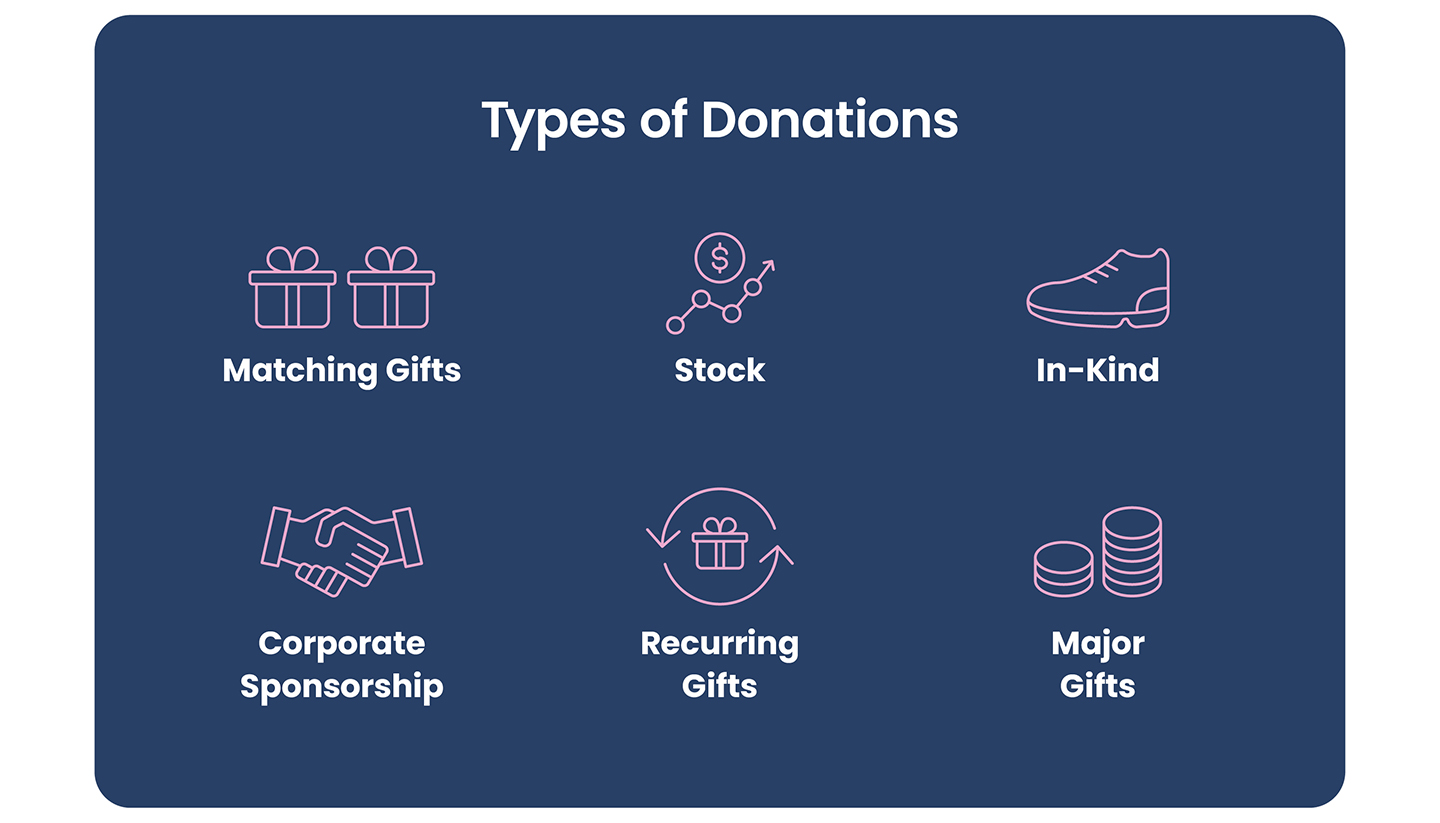

A donor goes to your website, clicks the “donate now” button, and it’s a donation. Right? Right. But it’s also a donation when someone volunteers at your event or when your friend says, “Sure, use my computer printer.” Every single donation can help your nonprofit!

This chapter will help you think outside the standard donation box and consider some previously untapped sources of donations.

Here’s a hint: replace the word “donation” with the word “support.” Maybe support looks like borrowed office space or a team of your friends staffing a 5K run for you. Maybe support looks like a matched gift or a sponsorship. It’s so much more than a monetary donation (though those are nice, too!). Let’s take a look at some different types of donations you might want to consider.

Matching gifts are, perhaps, the easiest way possible for nonprofits to raise money effortlessly. That’s because most companies have a philanthropic goal, and they meet it, in part, by matching charitable donations made by their employees.

While there are a few different ways to get matching gifts, we will shamelessly promote Double the Donation. CharityEngine has partnered with this organization for years to help our clients maximize their outreach efforts. How does it work? Any nonprofit can integrate with the match tool, which scans its database of companies in real-time as someone makes a donation. Once the software determines that the gift is eligible for a match, the donor is prompted to download and file the forms. There’s also an option for auto submission, in which the donor simply makes the gift, and the software does everything else until the matching gift is received. Matching gifts are an easy win for your nonprofit!

Now, we’re not getting kickbacks from Double the Donation. There are other options out there, but this is the one we know and we recommend to our clients.

Another source of funds for a nonprofit is stock. When an individual donates stock, they avoid the capital gains taxes they would have to pay if they sold it, and they will get a tax deduction for donating to a nonprofit.

You might think of stock donations only as gifts made posthumously or pledged by an elderly donor. Not so! Many tax-savvy donors have been turned on to the benefits of charitable gifts of stock, and it’s worth taking a look at your pool of donors – easy with a nonprofit CRM – and investigating whether or not this is a viable option and one you should promote.

Want to check it out? We like DonateStock. Similar to Double the Donation, DonateStock is an integration that allows donors to submit an online donation form. The software then routes the form to the donor’s broker, who transfers the stock to the nonprofit’s account. From there, you (the nonprofit) can choose to sell the stock and receive cash or receive the stock and add it to (or start!) an investment account for your organization.

A caveat: we are very, very good at helping nonprofits with donor management, engagement, and nonprofit fundraising. We are definitely not very, very good at tax advice. If matching gifts or stock are of interest, reach out to the organizations and then consult a tax professional.

When you think of in-kind donations for nonprofits, what comes to mind? For most of it, it’s tangible items, like computers, printers, office equipment, furniture (or, honestly, even office space).

But in the official world of in-kind donations, there are four types: loosely, tangible stuff, intangible stuff, time or services, and real estate. What they all have in common is that they are non-cash gifts.

Now, a note: if you want to, or have to, claim in-kind gifts on your financial statements, Generally Accepted Accounting Principles (GAAP) say they can be recognized under two conditions:

If you have questions about this, don’t call us! That’s a job for (and responsibility of) your accountant. We'll stick to our day jobs.

If you haven’t explored corporate sponsorship, it’s an important avenue of revenue for many nonprofits. And you’ll find that many companies that donate to nonprofits do so to fulfill budgetary guidelines. In other words, most large companies must donate to nonprofits…so why not yours?

Identify some companies that might share your mission or your neighborhood or that might have any reason to consider your nonprofit. And cast a wide net!

Think about the type of sponsorship you want. Is it a contribution to a capital campaign or an event? Is it signage, merchandise, or advertising?

It could also be a restaurant that caters your event or meeting, a spa that donates gift certificates to be raffled, or a grocery store that lets you set up space to collect groceries. Any for-profit entity can be a corporate sponsor.

Corporate sponsorship benefits the company because, frankly, it makes them look good. And it helps you by raising awareness of your mission (and maybe helping you attract new supporters), as well as boosting your credibility. It’s a win/win.

The health of a nonprofit can often be measured by sustainers, or those donors counted on for monthly giving. We’ve talked about ways you can strengthen recurring giving, which comes down to creating a successful sustained giving program. Our largest sustainer client has more than 250,000 monthly donors that give an average of $6 million a month. We know that’s not likely for many of our clients, but it gives us a great resource to mine for tips. Here are some of the basics used by that giant client to grow a strong sustainer program:

A healthy sustainer program is key to a healthy nonprofit, so take stock of yours and show it a little love if need be. It will pay dividends.

Sometimes nonprofits focus on major gifts because of a capital campaign or as part of a year-end giving appeal. But we would argue that focusing on major gifts all the time can yield unexpectedly fruitful results.

A major gift is usually the byproduct, or result, of a strong relationship with a donor. Like planned giving, a donor can give or bequeath stock or cash gifts that are often one-time and larger than standard donations. Major gifts can help recession-proof your nonprofit!

There are a few tips to keep top of mind throughout the year that will help you identify and capitalize on major gift donors:

One other related-ish topic: Donor Advised Funds (DAF). This is an account donors can create that exists for the sole purpose of supporting nonprofits they care about. This type of gift can offer significant tax savings to donors.

Ask your accountant for the lowdown on some of these options, and then let your supporters know they exist. When they’ve proven loyalty and you make giving easy, you’re knocking obstacles down as fast as they pop up.

Do you ever get asking fatigue? It stands to reason that when asking people for donations is your job, you can get weary.

And it would be so easy if there was some magical formula that would blow all other asking techniques out of the water, but that’s not the case. The old tried and true methods really do work! But when we dig into our clients’ stories, we can find some examples of twists that might get your mental cylinders firing with new ideas.

When we look at how to get donations for nonprofits, we start with the tools we think are most effective. They’re not flashy or new, but they're foundational to every one of our clients.

Email is the foundation of many fundraising strategies. You want your email to cut through the clutter, so look at your subject line to ensure it compels recipients to open it. Personalize the greeting, then consider the content. We consider an ideal length to be about 25 lines. Those 25 lines will be most impactful if you tap into the psychology of giving, which leads to our creative tip: start with a story of one impact your organization has had. If donors hear that 30,000 people need their help, they will assume they can’t make a dent in the need. If their donation helps one child, veteran, etc., they’re more compelled to give.

And please don’t forget one of the most important emails you’ll send: the donor thank-you email! Those emails help you build the relationships you need for strong recurring donations.

We’ve already talked pretty extensively about major gifts, but they bear repeating as an excellent way to ask for donations. Mine your CRM’s data for potential major gift donors. Our tip here is to use a handy RFM calculator tool to score your donors based on recency, frequency, and monetary value. You can use our RFM calculator for free.

This might sound a little unusual, but can you offer tiered levels of membership tied to benefits? If you can work dues into your fundraising plan, you have the ability to forecast with more precision, and you can create different stewardship plans for each significant pool of donors. The trick here is that the donors have to get something in return, which isn’t usually the case with standard donations. They can get branded t-shirts or other swag, or things like advocacy, communication, resources, access to events and forums, participation in calls or webinars, or even position papers.

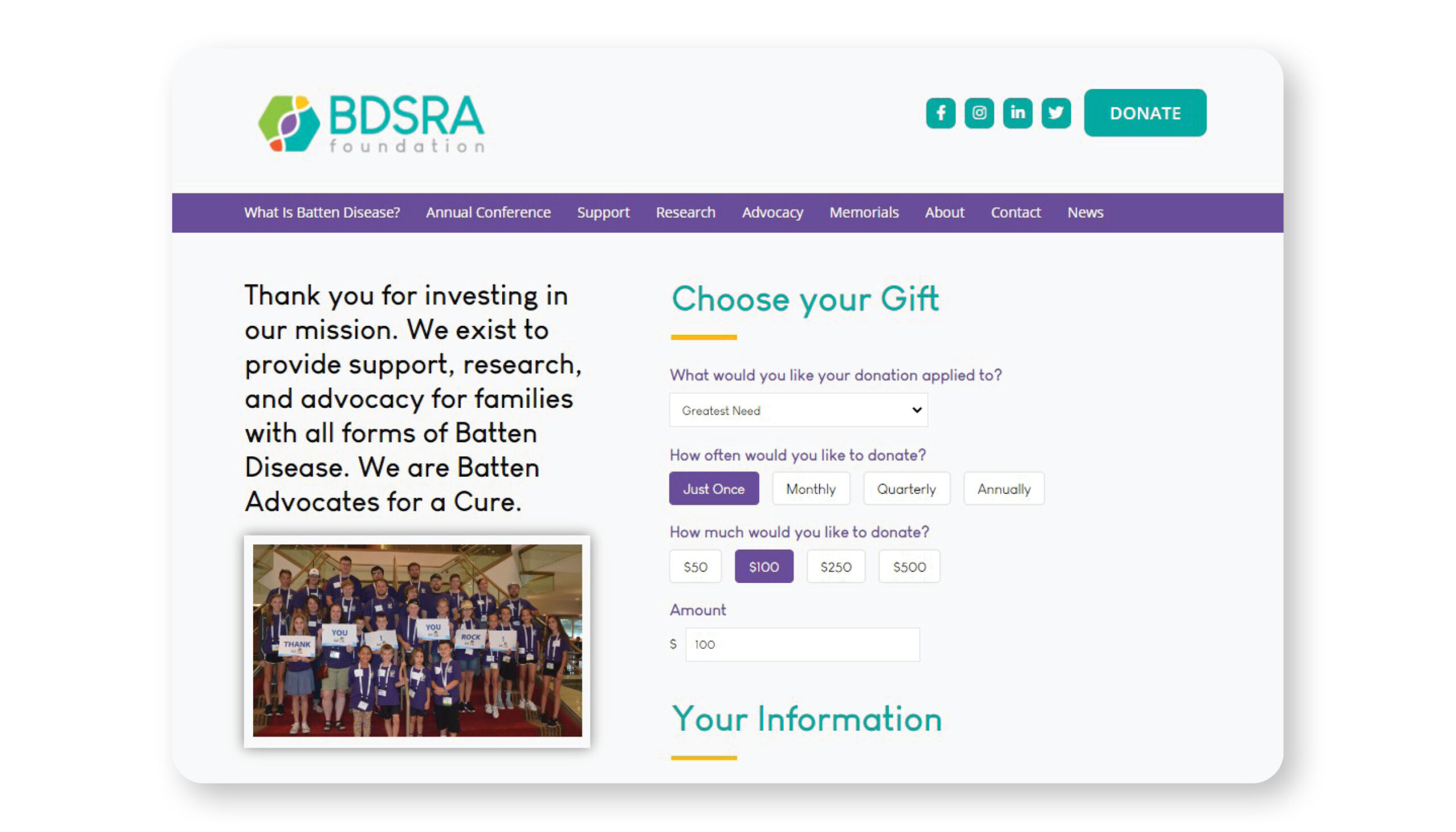

You’re wondering why your donation form is mentioned in a chapter about asking for donations, right? Well, your donation form is central to asking for donations. Our clients hear a mantra on repeat: make it easy to give. This means creatively driving traffic to your donation form and showcasing a fabulous, user-friendly donation form. The best are short and simple and crystal clear. Use your colors and brand to keep it engaging, offer suggested giving levels or the option to make it a recurring donation, and keep form fields to a minimum. We will cover this in a little more detail in a later chapter.

In the meantime, here are some examples of client donation forms.

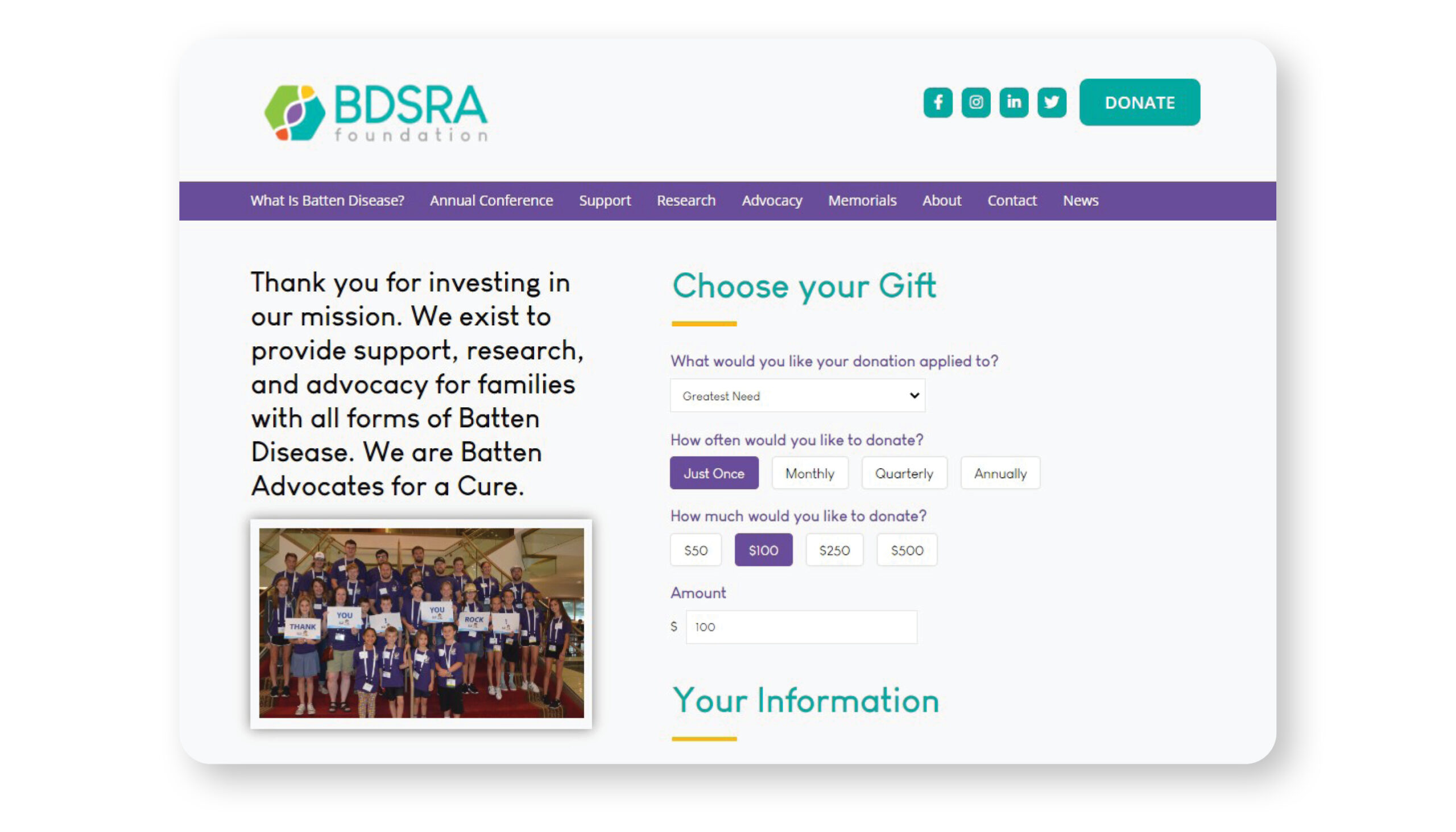

Here's BDSRA Foundation.

And here's an example from Food Bank for the Heartland.

We sell a CRM (and it’s a great one….), but this isn’t about our CRM. It’s about your CRM, regardless of your technology or vendor. Because all good CRMs will offer advanced reporting and analytics, and data gives you something you can act on. For example, you can slice and dice the data to see that 1,000 donors each give $10 a month. What if you ran a campaign targeting those donors and asked them to increase their donations by $2 a month? What if you extrapolated and realized you can ask all your donors the right questions, the right asks, to increase your fundraising? Segmenting your donors and personalizing your appeal will dramatically increase your chances for success.

You can also look at the data to find new donors. What if all your biggest donors are in one county? Go there, take them to lunch, and ask why they love your nonprofit. Then target the next county over with a campaign that capitalizes on the benefits felt by the first county. There’s no end to what your data can do for you as long as your reporting is accurate and your CRM is robust.

Sustainers are at risk of being a little taken for granted. They’re always there, faithfully plopping down their standard donation and never complaining about anything. THESE PEOPLE ARE GOLD! Sorry for shouting, but these are loyal, happy donors who love you. Love them back! Send them a little gift, pick up the phone and call them to express your gratitude, invite them to come to tour your facility and have lunch. Make sure they know how valued they are. This will be an important group when you want to ask for donations during a year-end campaign or other fundraising push.

We touched on this a little with the idea of membership but think about selling something rather than asking for donations. You can sell engraved bricks for a walkway or benches to line a green space. You can sell t-shirts and coffee mugs and pens and pads, all conveniently branded with your nonprofit logo. You can sell experiences like lunch-n-learns. You can sell tickets to events and raffles. You can get as creative as you want! If you work with kids, have them create art and then raffle it off. Work with animals? Create a photo calendar showcasing your residents. The options are only limited by your imagination.

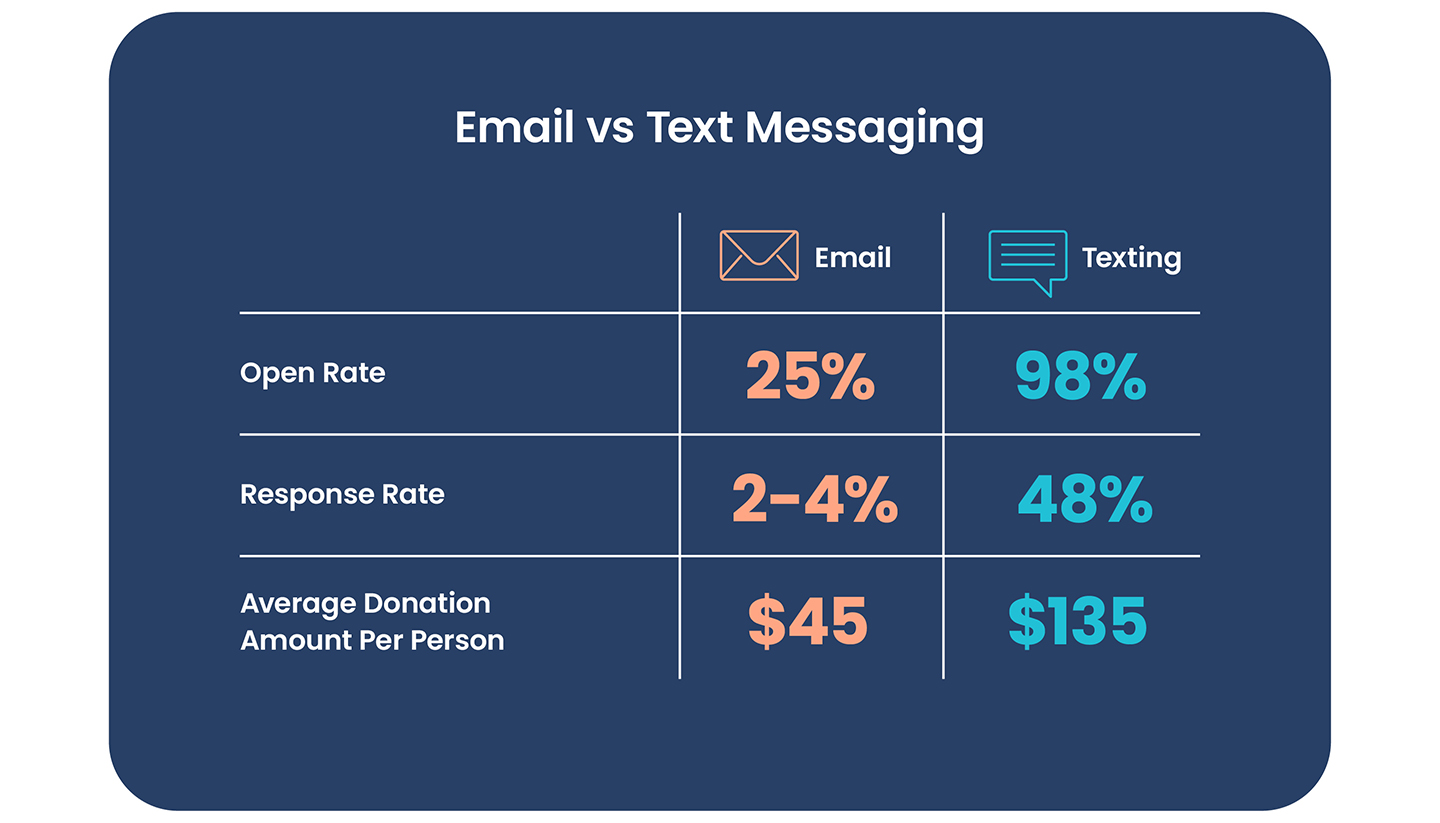

Mobile phones are ubiquitous and only getting smarter and more sophisticated. Leverage that and use your CRM to create a peer-to-peer campaign or use the mass text functionality. P2P campaigns can include walks or fun runs, or sales of popcorn or oranges, or they can just deputize your ambassadors to fundraise for you. We offer tips on how to run a great P2P campaign in this article. And mass texts are effective, too, because texts are opened at a rate of 98%, compared to a 25% open rate for email. Read this quick article for more on making mobile a key part of your fundraising plan.

And there you have it. Rocket science, no, but a handful of ideas you can use or build on to ask for donations in a way that will get some attention.

You do have to pay attention to the boring technical things…ideal length, email deliverability, spam scores, blah blah blah…but you can also push some messaging and creative limits with your donation emails.

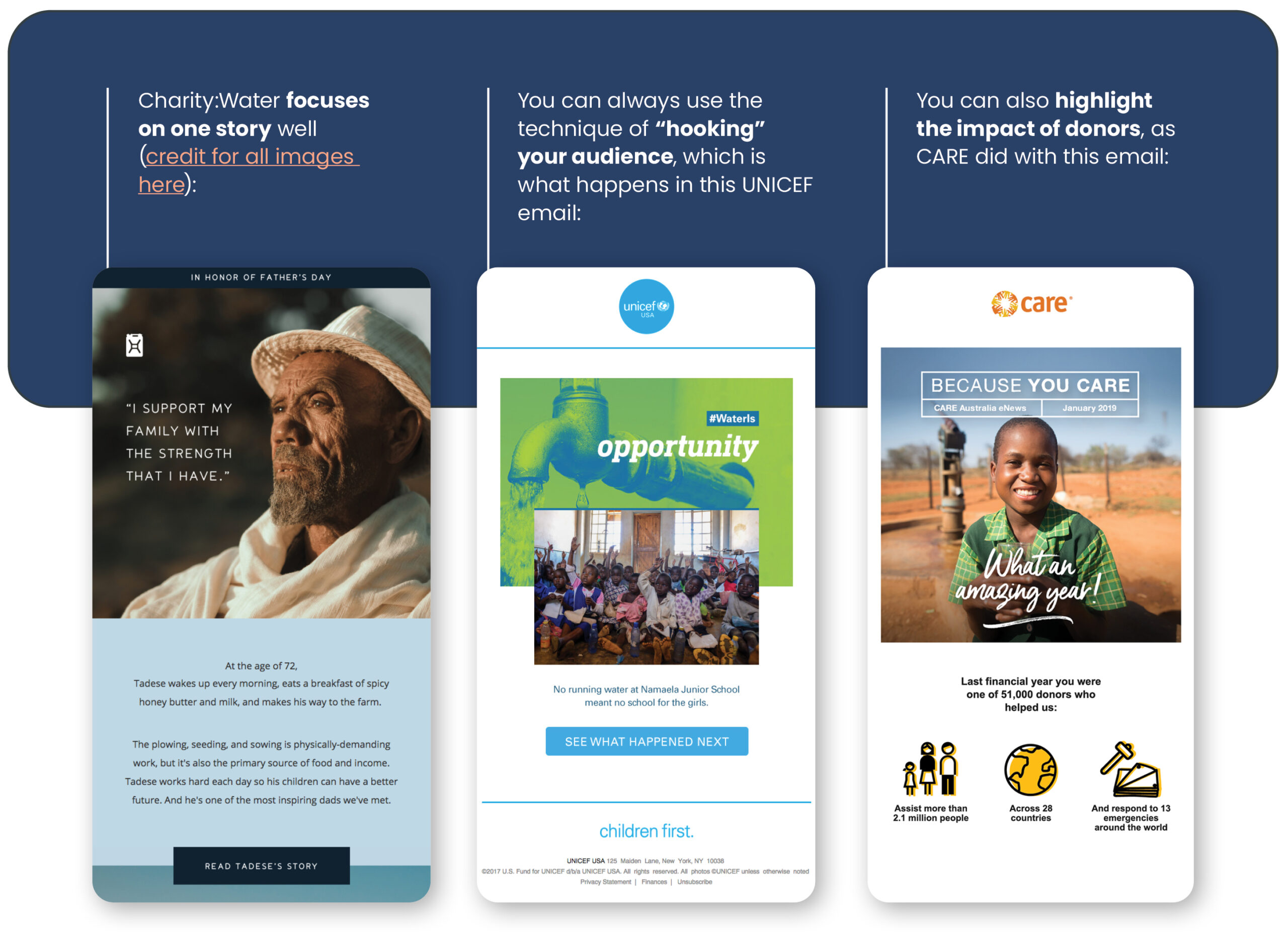

Remember that there will be a human being reading your email, and you want to elicit a response. Rather than focusing on data that illustrates the plight you support, focus on one story.

Charity:Water focuses on one story well (credit for all images here).

You can always use the technique of “hooking” your audience, which is what happens in this UNICEF email.

You can also highlight the impact of donors, as CARE did with this email.

Even if you don’t have a huge design or photography budget, you can write emails that get attention. Here are five tips for knock-your-socks-off emails:

Gosh, isn’t this the big question? You want to stay top of mind, but you don’t want to be a pain in the tushie.

Beware of experts yelling, “Two per month!” or “Six per week!” (okay, no one actually says that) because the question isn’t how many or when, it’s how many and when it’s right for your nonprofit and your audiences. Notice the plural…you have many audiences once you segment them. Look at one audience and develop good content that will resonate with them. Be certain you’re informing them about your mission, efforts, and impact. If you’ve asked them, via a signup form or a survey, how often they want to hear from you, that’s helpful.

You can also add a survey question to your emails, asking them to confirm their communication preferences.

For each segmented audience group, identify how often you can create compelling content and how often they want to receive it. And how often they need to receive it. Volunteers might need more frequent, detail-oriented emails than your major gifts folks.

Have you created a donor journey map? Once you do that - mapping out the stages of giving and determining which touchpoints are needed at each stage to compel action - you'll have the answer to how often you can send donation appeals to each donor persona you create.

Our friends at NextAfter have researched the best time of day to send fundraising emails. They’re nerdy in the best way, so if you want to nerd out with them, read their article. Like everything, they suggest you see what other nonprofits are doing and take a look at the habits of your donors to determine the best time for your nonprofit. The recommendation they offer is to send nonprofit emails right after lunch to stand out and maximize your chances of success.

Nonprofits work hard to get the word out, launch campaigns, spread awareness, entice new donors, invigorate current donors, and touch a few hearts along the way.

But the donation form? That’s where the pedal meets the metal. You can have off-the-charts good outreach that is sending millions of donors to your donation form. If it stinks, if they get frustrated or it’s unclear or just not easy to deal with, you could easily see donation form abandonment at about 50% to 70%.

Ouch.

So how can you make sure your millions of donors find the donation form of their dreams? Here are some tips for you.

And, because we’re into data, we will always recommend A/B testing. Create two different donation pages and change one thing, like the location of the donate button, and see which performs better when all other variables are equal. This way, you will eventually end up with the most successful version of your form.

Here are some donation forms that we like:

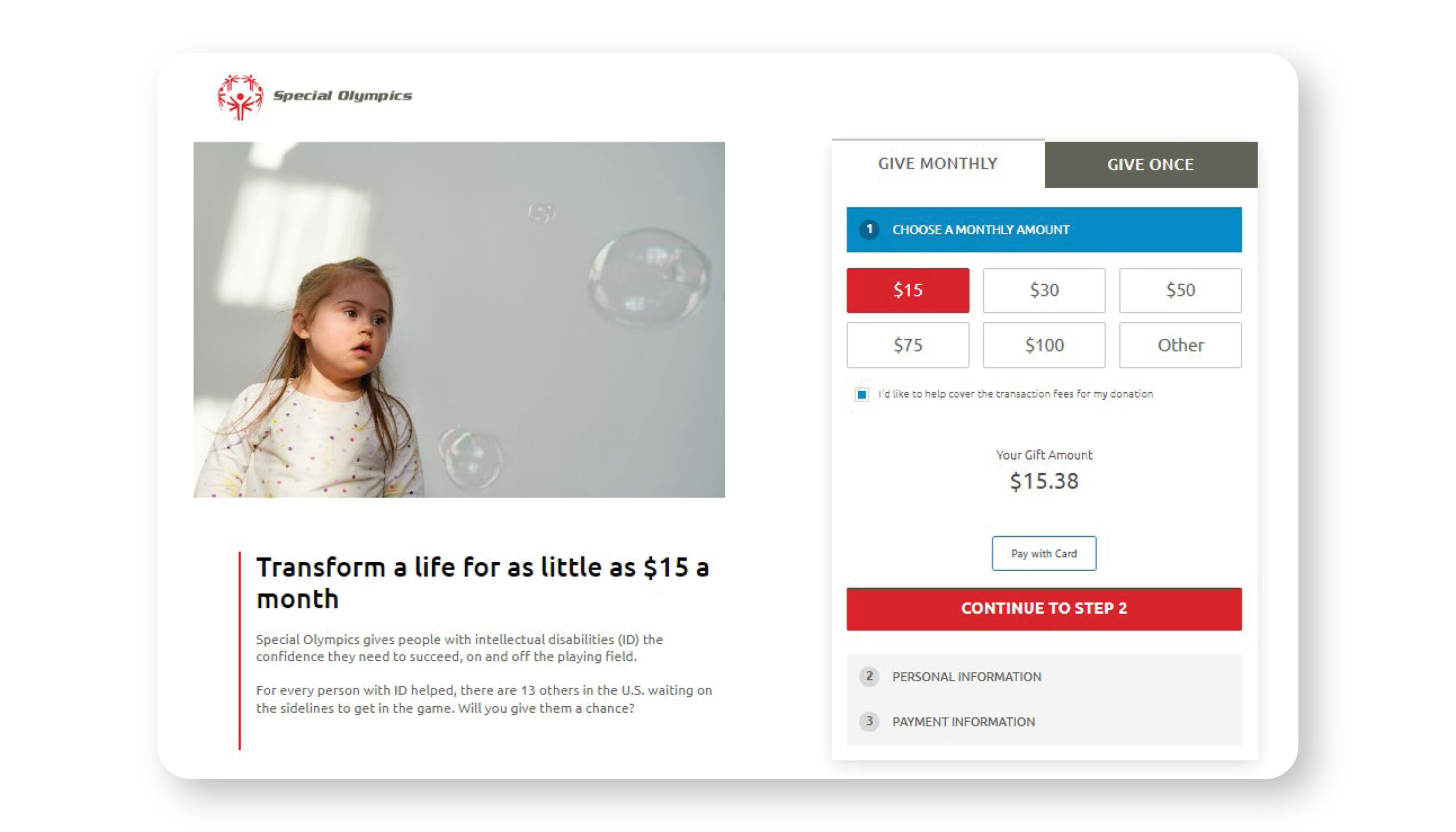

This Special Olympics donate form hits a lot of key points.

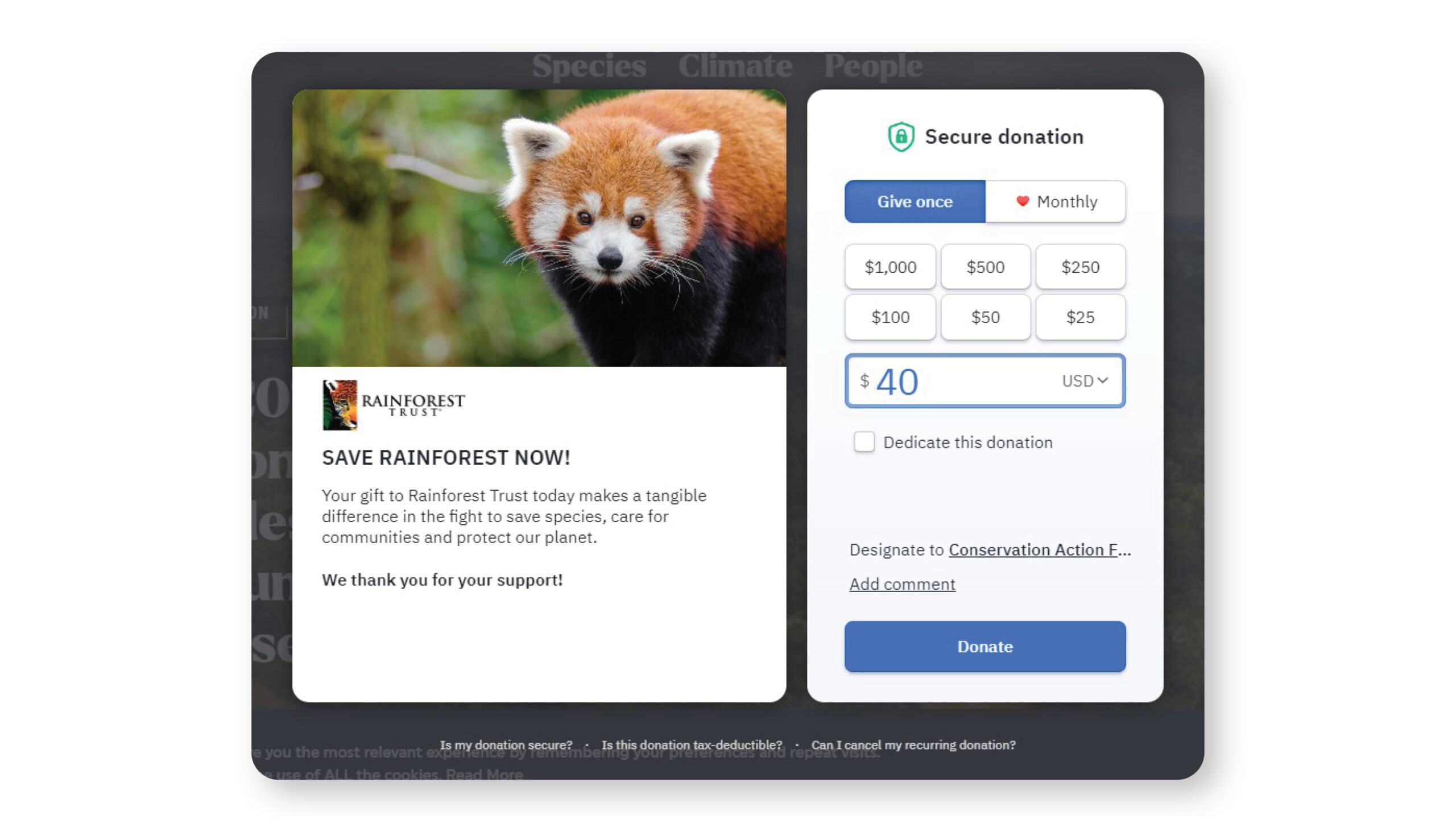

Rainforest Trust uses an effective technique, placing a lightbox to highlight its donation form. There's arresting imagery, the mission is included, it's easy to make the gift a recurring donation, and it's easy to dedicate the donation.

CharityEngine client BDSRA took advantage of the easy customization of our forms to hit a home run with their donation page. What do we like?

And finally, Food Bank for the Heartland used CharityEngine's out-of-the-box forms module to create this effective form. This client uses a great photo, a simple yet powerful headline, and statistics to drive home the need. Then they qualify every monetary gift which drives up their fundraising success. Preselecting a donation that funds 1,000 meals highlights how important a donation is.

While it’s lovely to think that philanthropic donations are driven by an abiding desire to help those in need, it’s not often the only reason someone decides to donate money. The silver lining is always that donated funds are exempt from taxes.

So let’s back up and go over the basics: if your nonprofit is compliant with all IRS regulations and has exempt status at the time of a donation, both the nonprofit and the donor can receive tax benefits. To document the transaction for your donor, your nonprofit must issue a receipt. You should issue a receipt immediately after the donation and issue a summary receipt at year end.

Please note that a good CRM will offer web forms that can be set to automatically acknowledge a donation and send a receipt. Technology will also make it easy to send individual or bulk receipts, like at the end of the year, and will be invaluable when it comes to tracking and monitoring receipts.

We all know Uncle Sam can be a little finicky if paperwork isn’t just so, and donation receipts are a biggie. If the receipt doesn’t contain all the right information, the IRS can reject it, and then you have an annoyed donor who might not come back and try to give again.

Send a receipt for every donation you receive.

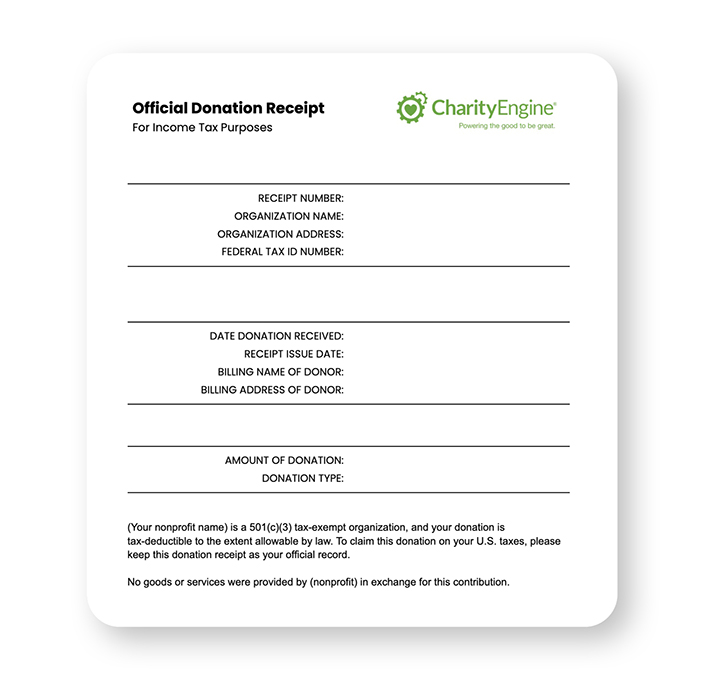

All receipts should have:

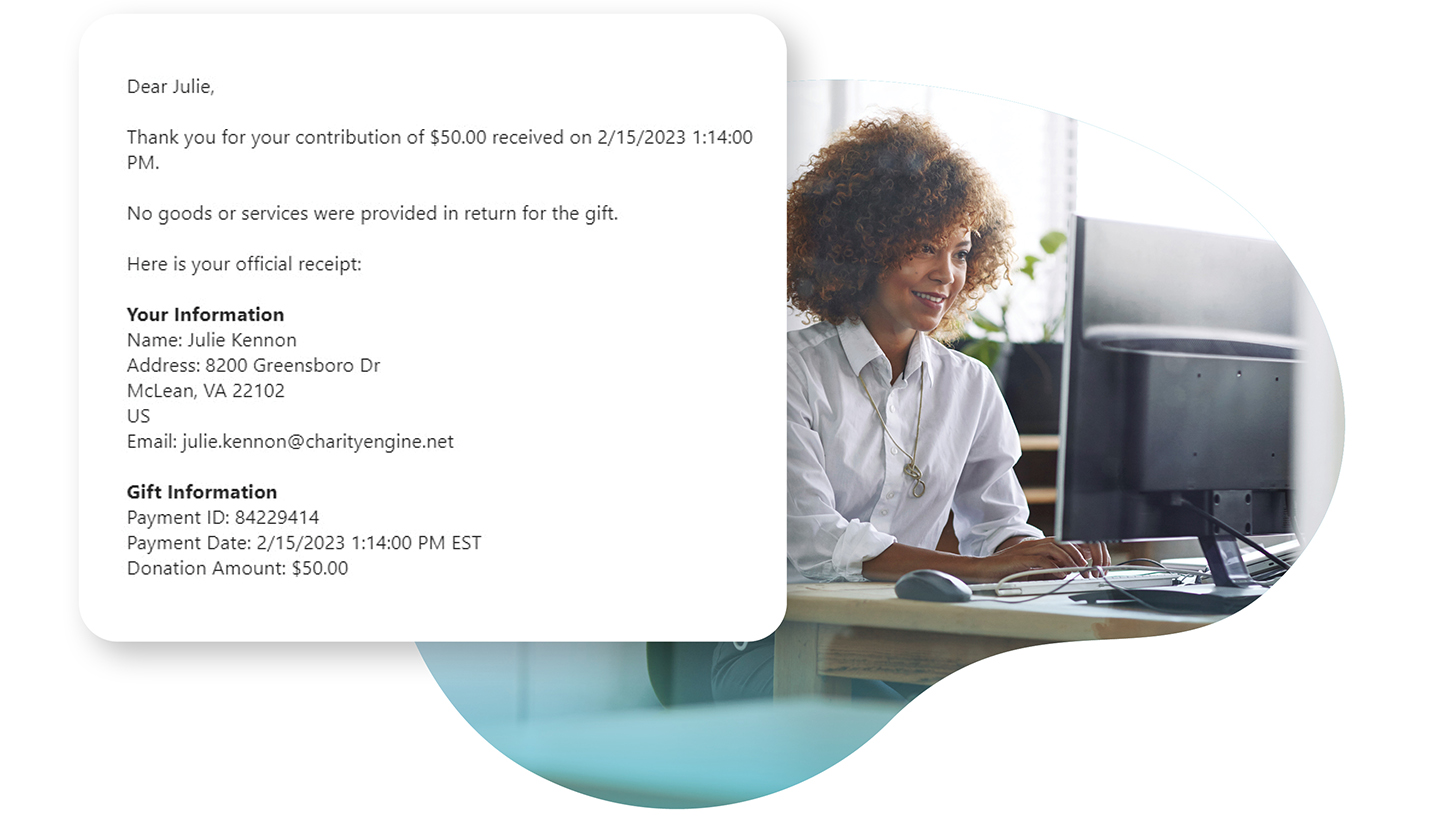

If your receipt is generated by your CRM, it might look something like this:

Many organizations will send an email with the information shown above and then attach a PDF of an official receipt.

If you would like to access a free donation receipt template, click here. As is always the case with our templates and workbooks, please go to file - > make a copy and then edit the template. Replace the CharityEngine logo with yours and insert your nonprofit’s information.

We’ve alluded to the importance of a robust CRM, because just as a rising tide lifts all the ships in the harbor, solid, dependable technology can make everything about your job running a nonprofit easier.

If you’re reading this, you know that CharityEngine sells a nonprofit CRM trusted by the biggest names, the growing organizations, and everyone in between. So we know a thing or two about how much technology can do.

Does that mean we are your only option? Nope. The industry offers plenty of excellent CRM vendors to choose from. And different vendors will offer different prices, functionality, training, and support, so you must do the research and find the best fit. We offer a free, comprehensive guide with worksheets you can use to identify which features are the most important for your nonprofit.

Core functionality from a nonprofit CRM includes:

These tools will allow you to manage your donors and engage with them to raise money. Additional modules some CRMs might offer take this a step further and feature functionality designed for specific types of outreach. These include tools for:

We like to think of a nonprofit CRM as the foundational technology needed to effectively run a nonprofit. And for a smaller or growing nonprofit, an all-in-one system that offers a comprehensive suite of tools right out of the box is an excellent option.

But even if you’re a smaller nonprofit content with an all-in-one system, you might want to add functionality from third-party systems to your CRM. So it’s important to make sure you have all the tools you need when you’re starting out, but it’s equally important you ask about the CRM's ability to integrate with a range of third-party systems.

If you have more questions about donations, please reach out, and we will be happy to help. We understand that donations power your nonprofit, and maximizing them is paramount to your growth and success.

CharityEngine exists to partner with nonprofits and make it easier to manage donors, engage supporters, and raise more money. If you want to see our software in action, we’d love to show it to you. Happy fundraising!

When it's time to think about switching CRMs. this guide is an invaluable tool you can use to discern which features are most important to your nonprofit and start comparing vendors. We even include two free worksheets!